Refinancing Solutions for U.S. Homeowners in Costa Rica

Already own a home in Costa Rica? Volo Loans helps U.S. citizens refinance their Costa Rican properties to reduce interest rates, access equity, or even finance a second home in paradise. With every loan funded and serviced in the U.S., you’ll avoid the delays, fees, and uncertainty of local lenders.

Max Loan-to-Value

Up to 75% LTV depending on property type, location, and borrower qualifications.

Interest Rates

Rates are based on SOFR index, often lower than Costa Rican banks, with fewer fees.

Loan Terms (up to 30 years)

Loan options include a 30-year fixed, a 7/6 ARM, or a 5/6 ARM with terms designed to fit your long-term plan.

Property Types Financed

Owner-occupied or investment properties already located in Costa Rica. We do not refinance U.S. homes.

How It Works

Submit your refinance request online. We’ll review your property and goals.

We’ll help verify the current value and review your equity access options.

With full servicing in the U.S., most loans close in as little as 30 days.

Eligibility & Requirements

US Citizenship or Residency

You must be a U.S. citizen or permanent resident with an existing property in Costa Rica to qualify for a refinance.

Minimum Credit Score

We require a U.S. credit score of 680 or higher. Costa Rican credit history is not used in our evaluations.

Proof of Income

We review consistent income sources such as pay stubs, W-2s, tax filings, or verified self-employed earnings.

Down Payment Percentage

While refinancing doesn’t require a down payment, equity requirements apply. In some cases, a new valuation may be required to confirm eligibility.

Market Insights

Frequently Asked Questions

Can I refinance a U.S. property with Volo Loans?

No, Volo Loans exclusively refinances residential properties located in Costa Rica. If you own a U.S. home, it won’t be eligible under our programs. Our services are built specifically for U.S. citizens looking to manage, improve, or expand their real estate holdings in Costa Rica.

Can I use the equity from my current property to buy another home in Costa Rica?

Yes. Many of our clients choose to tap into their existing home equity through a cash-out refinance in order to purchase a second property. Whether that’s a rental investment, a retirement home, or a vacation escape. We’ll help assess your equity and structure the loan to support your next move.

Will I need to get an appraisal before refinancing?

Yes. A recent and credible property appraisal is required to determine the current value of your home and ensure you meet our loan-to-value (LTV) guidelines. This valuation helps us calculate how much equity you can access and what loan terms may apply.

Do I need to have a Costa Rican credit history to qualify?

Not at all. Volo Loans bases your refinance eligibility entirely on your U.S. credit history and financial documentation. You won’t need to build local credit or navigate unfamiliar financial systems to qualify.

How long does it usually take to complete a refinance?

Most refinance loans with Volo close in as little as 30 days from the time you apply. Because we handle everything through U.S.-based systems and licensed professionals, the process is faster and more transparent than working with local lenders in Costa Rica, who may take several months longer to close.

I’ve lived in this area for 34 years and have been selling real estate here for about 5 years. Recently, I had the opportunity to help Jamie purchase a beautiful three-bedroom, three-bath condo in Altos de Montserrat, just outside of Los Sueños. The deal was a little touch-and-go at first, but once we got involved with Volo Loans, everything changed. They helped Jamie get all the paperwork he needed, guided him through escrow, and made the loan process very easy and pleasant. We ended up with a wonderful, successful closing. It was truly a pleasure to work with them, and I highly recommend Volo Loans. I look forward to doing more deals with them in the upcoming months.

Pam H., Volo Customer

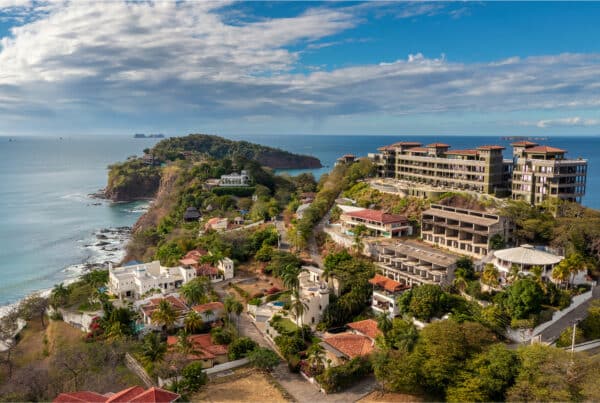

Your Global Property Journey Starts Here

We make it easy to buy property abroad, starting with Costa Rica and expanding worldwide. Pre-qualify today and unlock expert guidance, U.S. compliance, and fast closings across borders.