International Home Loans for U.S. Buyers

Dreaming of a vacation home, second residence, or full-time relocation to Costa Rica? Our home loan solutions are built specifically for U.S. citizens with no unfamiliar credit requirements and no complex guesswork. Just a straightforward path to ownership with fixed or adjustable rate options, a 30–60 day close, and expert guidance every step of the way.

Max Loan-to-Value

Up to 75% LTV for eligible properties. We assess each opportunity to match your goals with the best available terms.

Interest Rates

Rates are based on SOFR index, typically offering better terms than Costa Rican lenders. Fixed and ARM options available.

Loan Terms (up to 30 years)

Choose between 5/6 ARM, 7/6 ARM, or a 30-Year Fixed—depending on your goals and long-term plans.

Property Types Financed

Single-family homes, condos, townhomes, and approved multi-unit properties in Costa Rica.

How It Works

Submit your application online in minutes—no Costa Rican credit history required.

Shop with confidence, knowing your financing is backed by a U.S. lender.

We handle the title work, legal details, and compliance—all in English.

Eligibility & Requirements

US Citizenship or Residency

Volo Loans is built for U.S. buyers financing residential property in Costa Rica. You must have U.S. citizenship or permanent residency to qualify.

Minimum Credit Score

We require a credit score of 680 or higher. Our loan officers review your U.S. credit history, not foreign data.

Proof of Income

We’ll verify consistent income through tax documents, pay stubs, or verified business revenue.

Down Payment Percentage

All loan options require a minimum down payment of 25% of the lesser of the purchase price or appraised value. Most buyers contribute 30% or more for a down payment.

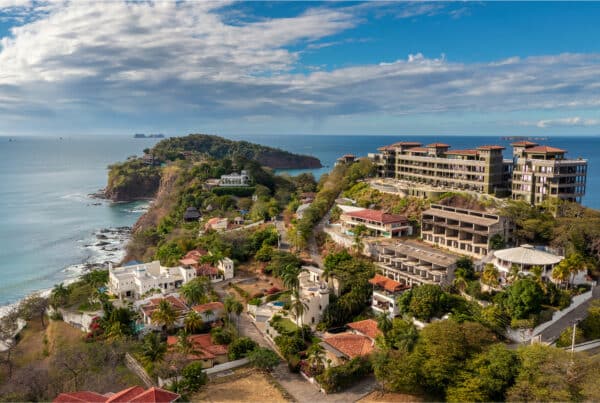

Market Insights

Frequently Asked Questions

What types of homes can I finance in Costa Rica with Volo Loans?

Volo Loans provides financing for a variety of residential property types in Costa Rica, including single-family homes, condos, and townhomes. We can help if you’re purchasing a vacation home or relocating full-time. Investment or rental properties may also qualify, provided they meet our residential use and legal eligibility criteria under Costa Rican real estate law.

Do I need a Costa Rican credit history or residency to apply for a home loan?

No, and that’s one of the biggest advantages of working with Volo Loans. We base your loan eligibility entirely on your U.S. credit profile and financial documentation. There’s no need to establish Costa Rican credit or residency, which saves you time and removes a major barrier to purchasing property abroad.

How long does the home loan process take from start to finish?

Most Volo Loans home purchases close in about 30 to 60 days. That’s significantly faster than the typical 8 to 12 months it can take with local Costa Rican banks. Our U.S.-based processing, transparent documentation, and deep familiarity with Costa Rican real estate law help keep things moving efficiently.

Can I finance a vacation rental property in Costa Rica?

Yes, you can—if the property is legally categorized for residential use. Many of our clients finance vacation homes that they later use as part-time rentals or seasonal residences. We’ll help ensure the property meets the local legal and zoning standards before you proceed.

Where are the loans funded and serviced?

All loans through Volo Loans are funded and serviced in the United States. This means you benefit from the predictability of U.S. regulatory protections, easier communication, and clear expectations for payments and support, without having to navigate local banking infrastructure or policies.

Financing properties in Costa Rica was a real challenge for me. Volo changed that. Their process was easy and professional, and the underwriting felt just like what I’m used to in the States. I was able to cash out my first property and reinvest in another. I’m now on my third deal with them and growing my vacation rental business there.

Kenny N., Volo Customer

Your Global Property Journey Starts Here

We make it easy to buy property abroad—starting with Costa Rica, expanding worldwide. Pre-qualify today and unlock expert guidance, U.S. compliance, and fast closings across borders.