Predictable for 7 Years, Flexible After That

A 7/6 Adjustable Rate Mortgage (ARM) starts with seven years of a locked-in rate, giving you steady payments early on. After that, your rate adjusts every six months. For many international buyers, this hybrid loan model offers a strategic mix of initial certainty and future flexibility.

Whether you’re planning a future sale, expecting increased income, or simply prefer lower upfront rates, a 7/6 ARM lets you buy confidently today, without locking into a long-term rate you might not need.

30-year loan term

Fixed interest rate for 7 years, then adjusts every 6 months

Up to 75% Loan to Value (LTV)*

No fees for early repayment

Rates based on US SOFR (Secured Overnight Financing Rate) Index

A Smarter Way to Buy Property Abroad

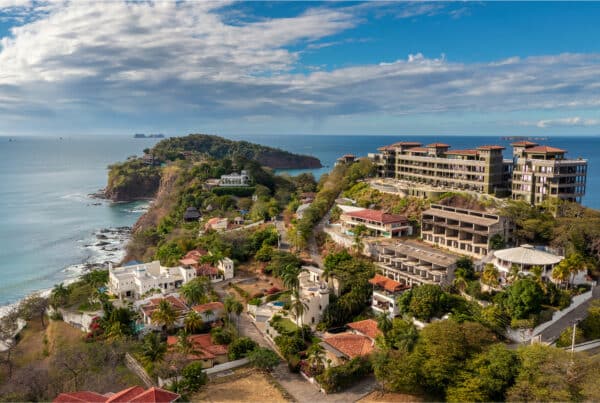

At Volo Loans, we specialize in helping U.S. citizens finance residential property in Costa Rica. Our loans are fully funded and serviced in the U.S., which means you get U.S.-grade clarity, speed, and compliance, backed by loan officers who speak both your language and the language of international real estate.

You’ll skip the long waits, confusing terms, and red tape common with local lenders. Most of our loans close in as little as 30 days, with full transparency and hands-on support.

Our Process

Submit your application online in minutes—no foreign credit needed.

Explore with confidence equipped with a Volo Loans pre-approval.

We’ll help you handle cross-border compliance, title, and documentation.

I’ve lived in this area for 34 years and have been selling real estate here for about 5 years. Recently, I had the opportunity to help Jamie purchase a beautiful three-bedroom, three-bath condo in Altos de Montserrat, just outside of Los Sueños. The deal was a little touch-and-go at first, but once we got involved with Volo Loans, everything changed. They helped Jamie get all the paperwork he needed, guided him through escrow, and made the loan process very easy and pleasant. We ended up with a wonderful, successful closing. It was truly a pleasure to work with them, and I highly recommend Volo Loans. I look forward to doing more deals with them in the upcoming months.

Maria J., Volo Loans Buyer’s Agent

Market Insights

Frequently Asked Questions

What does “7/6 ARM” mean in real estate loans?

A 7/6 ARM is a 30-year mortgage where the interest rate is fixed for the first 7 years, then adjusts every 6 months. It provides a stable payment period before adapting to market conditions.

How often can the interest rate change on a 7/6 ARM?

After the 7-year fixed term, the rate can adjust every 6 months based on the US SOFR (Secured Overnight Financing Rate) Index and margin. These changes can increase or decrease your monthly payment depending on market rates.

Is a 7/6 ARM a good choice for Costa Rica property?

Yes. If you’re a U.S. citizen purchasing a home in Costa Rica and want lower initial payments with flexibility later, a 7/6 ARM may be a smart fit.

What are the benefits of a 7/6 adjustable mortgage?

You get a lower starting interest rate than a fixed mortgage and a 7-year cushion before any changes. This works well for buyers planning to sell, refinance, or pay off within that time.

How is this loan different from financing with a Costa Rican bank?

Volo Loans offers U.S.-regulated loans funded and serviced in the U.S. You’ll get faster closings, English-speaking support, and transparent terms, unlike the often complex and delayed local lending process.

Do you charge penalties for early payoff?

No. You can pay off your loan early at any time without extra fees or penalties.

Your Global Property Journey Starts Here

Start your pre-qualification online and close in as little as 30 days. Volo Loans is fast, secure, and powered by U.S. lending infrastructure.